[This page was last updated on 13th January 2024 in-line with the current version of the Employment Act on that date]

A Legislative History relating to the Singapore Employment Act can be found here.

EMPLOYMENT ACT

(CHAPTER 91)

(Original Enactment: Act 17 of 1968)

2020 REVISED EDITION

This revised edition incorporates all amendments up to and including 1 December 2021 and comes into operation on 31 December 2021

An Act relating to employment.

[15th August 1968]

PART 1

PRELIMINARY

Short title

1. This Act may be cited as the Employment Act.

Interpretation

2.—(1) In this Act, unless the context otherwise requires —

“approved medical institution” means a hospital, clinic, healthcare establishment or other medical institution which the Minister, by notification in the Gazette, declares as an approved medical institution*

* See section 48(1) of the Employment (Amendment) Act 2008 (Act 32 of 2008).

“authorised officer” means any public officer appointed as an authorised officer under section 3(2);

[Act 27 of 2015 wef 22/08/2015]

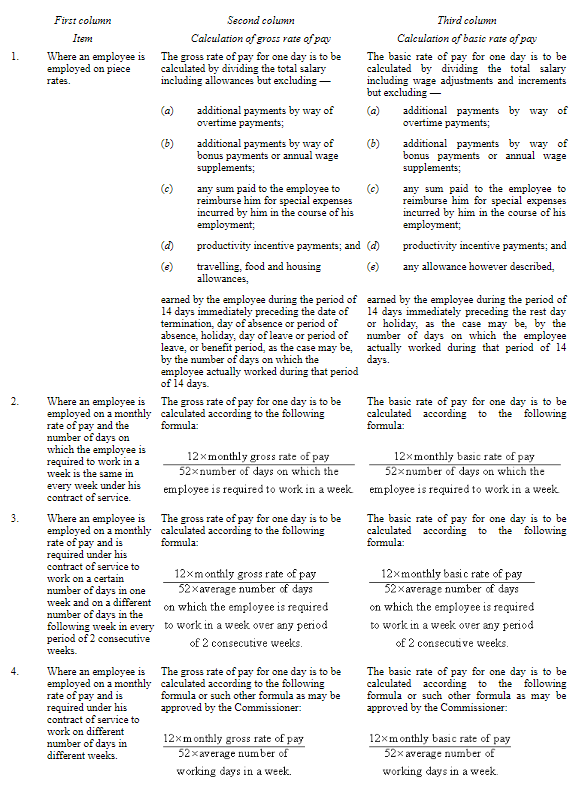

“basic rate of pay” means the total amount of money (including wage adjustments and increments) to which an employee is entitled under his or her contract of service either for working for a period of time, that is, for one hour, one day, one week, one month or for such other period as may be stated or implied in his or her contract of service, or for each completed piece or task of work but does not include —

(a) additional payments by way of overtime payments;

(b) additional payments by way of bonus payments or annual wage supplements;

(c) any sum paid to the employee to reimburse him or her for special expenses incurred by him or her in the course of his or her employment;

(d) productivity incentive payments; and

(e) any allowance however described;

[19/2021]

“civil contravention” means a contravention that is declared to be a civil contravention under section 126A;

[Act 27 of 2015 wef 01/04/2016]

“collective agreement” means an agreement as defined under the Industrial Relations Act 1960 (Cap. 136);

“confinement” means the delivery of a child (including a stillborn child);

[Act 19 of 2021 wef 01/11/2021]

“constructional contractor” means any person, firm, corporation or company who or which is established for the purpose of undertaking, either exclusively or in addition to or in conjunction with any other business, any type of constructional work, and who or which is carrying out the constructional work for or on behalf of some other person under a contract entered into by that person, firm, corporation or company with such other person, and includes heirs, executors, administrators, assigns and successors of that person, firm, corporation or company;

[19/2021]

“constructional work” means any building and civil engineering work and includes repair, maintenance, alteration and demolition work;

“contract of service” means any agreement, whether written or oral, express or implied, whereby one person agrees to employ another as an employee and that other agrees to serve his or her employer as an employee and includes an apprenticeship contract or agreement;

[19/2021]

“contractor” means any person who contracts with a principal to supply labour or to carry out the whole or any part of any work undertaken by the principal in the course of or for the purposes of the principal’s trade or business;

“day” means a period of 24 hours beginning at midnight;

“dependant” means any of the following members of an employee’s family, namely, wife, husband, father, mother, child and any adopted or illegitimate child living with or dependent on the employee;

[19/2021]

“dismiss” means to terminate the contract of service between an employer and an employee at the employer’s initiative, with or without notice and for cause or otherwise, and includes the resignation of an employee if the employee can show, on a balance of probabilities, that the employee did not resign voluntarily but was forced to do so because of any conduct or omission, or course of conduct or omissions, engaged in by the employer;

[Act 55 of 2018 wef 01/04/2019, 19/2021]

“domestic worker” means any house, stable or garden servant or motor car driver, employed in or in connection with the domestic services of any private premises;

“employee” means a person who has entered into or works under a contract of service with an employer and includes a workman, and any officer or employee of the Government included in a category, class or description of such officers or employees declared by the President to be employees for the purposes of this Act or any provision thereof, but does not include any of the following:

(a) any seafarer;

[Act 6 of 2014 wef 01/04/2014]

(b) any domestic worker;

(c) [Deleted by Act 55 of 2018 wef 01/04/2019]

(d) any person belonging to any other class of persons whom the Minister may, from time to time by notification in the Gazette, declare not to be employees for the purposes of this Act;

[Act 55 of 2018 wef 01/04/2019, 19/2021]

“employer” means any person who employs another person under a contract of service and includes —

(a) the Government in respect of such categories, classes or descriptions of officers or employees of the Government as are declared by the President to be employees for the purposes of this Act;

(b) any statutory authority;

(c) the duly authorised agent or manager of the employer; and

(d) the person who owns or is carrying on or for the time being responsible for the management of the profession, business, trade or work in which the employee is engaged;

“gross rate of pay” means the total amount of money including allowances to which an employee is entitled under his contract of service either for working for a period of time, that is, for one hour, one day, one week, one month or for such other period as may be stated or implied in his contract of service, or for each completed piece or task of work but does not include —

(a) additional payments by way of overtime payments;

(b) additional payments by way of bonus payments or annual wage supplements;

(c) means the total amount of money including allowances to which an employee is entitled under his or her contract of service either for working for a period of time, that is, for one hour, one day, one week, one month or for such other period as may be stated or implied in his or her contract of service, or for each completed piece or task of work but does not include;

(d) productivity incentive payments; and

(e) travelling, food or housing allowances;

“hours of work” means the time during which an employee is at the employer’s disposal and is not free to dispose of his or her own time and movements exclusive of any intervals allowed for rest and meals;

[19/2021]

“industrial undertaking” means public and private undertakings and any branch thereof and includes particularly —

(a) mines, quarries and other works for the extraction of minerals from the earth;

(b) undertakings in which articles are manufactured, assembled, altered, cleaned, repaired, ornamented, finished, adapted for sale, broken up or demolished, or in which materials are transformed, including undertakings engaged in shipbuilding, or in the generation, transformation or transmission of electricity or motive power of any kind;

(c) undertakings engaged in constructional work; and

(d) undertakings engaged in the transport of passengers or goods by road, rail, sea, inland waterway or air, including the handling of goods at docks, quays, wharves, warehouses or airports;

“inspecting officer” means any person appointed as an inspecting officer under section 3(2);

“machinery” includes all oil engines, gas engines, steam engines and any other machines in which mechanical movement, either linear or rotated or both, takes place, steam boilers, gas cylinders, air receivers, steam receivers, steam containers, cast iron underfired vulcanizers, refrigerating plants, pressure receivers, all appliances for the transmission of power by ropes, belts, chains, driving straps or bands or gearing, electrical generators and electrical motors;

“mediation request” has the meaning given by section 2(1) of the Employment Claims Act 2016;

[19/2021]

“medical officer” means —

(a) a medical practitioner employed by the Government or an approved medical institution; or

(b) any other medical practitioner whom the Minister declares, by notification in the Gazette, to be a medical officer for the purposes of this Act;

[Act 55 of 2018 wef 01/04/2019]

“medical practitioner” means a medical practitioner registered under the Medical Registration Act 1997, and includes a dentist registered under the Dental Registration Act 1999;

[Act 55 of 2018 wef 01/04/2019, 19/2021]

“no-pay leave”, for an employee, means leave of absence without pay granted by the employer at the request of the employee;

[Act 27 of 2015 wef 22/08/2015]

“overtime” means the number of hours worked in any one day or in any one week in excess of the limits specified in Part 4;

[19/2021]

“place of employment” means any place provided by the employer where work is carried on, for or on behalf of an employer, by an employee;

“principal” means any person who, in the course of or for the purposes of the person’s trade or business, contracts with a contractor for the supply of labour or for the execution by the contractor of the whole or any part of any work undertaken by the principal;

[19/2021]

“productivity incentive payment” means a variable payment, whether made annually or otherwise, to an employee as a reward for —

(a) an improvement to the employee’s performance; or

(b) an increase in the employee’s productivity or contribution to the employer’s business, trade or undertaking,

but does not include any payment which forms part of the employee’s regular remuneration;

“quarters” means any building provided or intended to be provided for a workman to live in either temporarily or permanently and includes any room or building used or intended to be used whether communally or privately for the purposes of cooking, eating, washing or bathing and any latrines and urinals;

“salary” means all remuneration including allowances payable to an employee in respect of work done under his or her contract of service, but does not include —

(a) the value of any house accommodation, supply of electricity, water, medical attendance, or other amenity, or of any service excluded by general or special order of the Minister published in the Gazette;

(b) any contribution paid by the employer on his own account to any pension fund or provident fund;

(c) any travelling allowance or the value of any travelling concession;

(d) any sum paid to the employee to reimburse him or her for special expenses incurred by him or her in the course of his or her employment;

(e) any gratuity payable on discharge or retirement; and

(f) any retrenchment benefit payable on retrenchment;

“seafarer” means any person, including the master, who is employed or engaged or works in any capacity on board a ship, but does not include —

(a) a pilot;

(b) a port worker;

(c) a person temporarily employed on the ship during the period it is in port; and

(d) a person who is employed or engaged or works in any capacity on board a harbour craft or pleasure craft licensed under regulations made under section 41 of the Maritime and Port Authority of Singapore Act 1996, when the harbour craft or pleasure craft is used within a port declared by the Minister under section 3 of that Act;

[Act 6 of 2014 wef 01/04/2014, 19/2021]

“stillborn child” has the meaning given by section 2(1) of the Registration of Births and Deaths Act 2021;

[Act 19/2021 wef 29/05/2022]

“subcontractor” means any person who contracts with a contractor for the supply of labour or for the execution by the subcontractor of the whole or any part of any work undertaken by the contractor for the contractor’s principal, and includes any person who contracts with a subcontractor to supply labour or to carry out the whole or any part of any work undertaken by the subcontractor for a contractor;

[19/2021]

“subcontractor for labour” means any person who contracts with a contractor or subcontractor to supply the labour required for the execution of the whole or any part of any work a contractor or subcontractor has contracted to carry out for a principal or contractor, as the case may be;

“Tribunal” means an Employment Claims Tribunal constituted under section 4 of the State Courts Act 1970;

[19/2021]

“wages” means salary;

“week” means a continuous period of 7 days;

“workman” means —

(a) any person, skilled or unskilled, who has entered into a contract of service with an employer pursuant to which he or she is engaged in manual labour, including any artisan or apprentice, but excluding any seafarer or domestic worker;

(b) any person, other than clerical staff, employed in the operation or maintenance of mechanically‑propelled vehicles used for the transport of passengers for hire or for commercial purposes;

(c) any person employed partly for manual labour and partly for the purpose of supervising in person any workman in and throughout the performance of his or her work:

Provided that when any person is employed by any one employer partly as a workman and partly in some other capacity or capacities, that person is deemed to be a workman unless it can be established that the time during which that workman has been required to work as a workman in any one salary period as defined in Part 3 has on no occasion amounted to or exceeded one‑half of the total time during which that person has been required to work in such salary period;

(d) any person specified in the First Schedule;

(e) any person whom the Minister may, by notification in the Gazette, declare to be a workman for the purposes of this Act.

[6/2014; 27/2015; 21/2016; 55/2018; 19/2021]

(2) [Deleted by Act 55 of 2018 wef 01/04/2019]

Appointment of officers

3.—(1) The Minister may appoint an officer to be styled the Commissioner for Labour (referred to in this Act as the Commissioner) and also one or more officers to be styled Deputy Commissioner for Labour, Principal Assistant Commissioner for Labour or Assistant Commissioner for Labour, who, subject to such limitations as may be prescribed, may perform all duties imposed and exercise all powers conferred on the Commissioner by this Act, and every duty so performed and power so exercised shall be deemed to have been duly performed and exercised for the purposes of this Act.

(2) The Minister may appoint such number of authorised officers, inspecting officers and other officers as he may consider necessary or expedient for the purposes of this Act.

[21/84]

[Act 27 of 2015 wef 22/08/2015]

(3) The Commissioner may in writing appoint an individual (who may or may not be a public officer) as an authorised person for the purpose of carrying out any function or duty of the Commissioner under this Act or any other written law relating to employment, employment terms or the relations between employers and employees.

[Act 21 of 2016 wef 01/04/2017]

(4) The Commissioner must, in writing, issue to each authorised person an authorisation specifying —

(a) the functions and duties of the Commissioner that the authorised person is authorised to carry out;

(b) the powers of the Commissioner that the authorised person is authorised to exercise;

(c) the conditions of the authorisation; and

(d) the limitations to which the authorisation is subject.

[Act 21 of 2016 wef 01/04/2017]

Rules and orders

4. The Minister may from time to time make rules and orders for the conduct of the duties of officers under this Act.

Minister may restrict application

5. The Minister may, by notification in the Gazette, declare that this Act or any Part or provisions thereof shall not apply to any premises or class of premises specified in the notification.

Existing law not affected

6. Nothing in this Act shall operate to relieve any employer of any duty or liability imposed upon him by the provisions of any other written law for the time being in force or to limit any powers given to any public officer by any other written law.

Invalidity of contract of service

7. [Repealed by Act 32 of 2008]

PART 2

CONTRACTS OF SERVICE

Illegal terms of contract of service

8. Every term of a contract of service which provides a condition of service which is less favourable to an employee than any of the conditions of service prescribed by this Act shall be illegal, null and void to the extent that it is so less favourable.

[32/2008]

Termination of contract

9.—(1) A contract of service for a specified piece of work or for a specified period of time shall, unless otherwise terminated in accordance with the provisions of this Part, terminate when the work specified in the contract is completed or the period of time for which the contract was made has expired.

(2) A contract of service for an unspecified period of time shall be deemed to run until terminated by either party in accordance with the provisions of this Part.

Notice of termination of contract

10.—(1) Either party to a contract of service may at any time give to the other party notice of his intention to terminate the contract of service.

(2) The length of such notice shall be the same for both employer and employee and shall be determined by any provision made for the notice in the terms of the contract of service, or, in the absence of such provision, shall be in accordance with subsection (3).

(3) The notice to terminate the service of a person who is employed under a contract of service shall be not less than —

(a) one day’s notice if he has been so employed for less than 26 weeks;

(b) one week’s notice if he has been so employed for 26 weeks or more but less than 2 years;

(c) 2 weeks’ notice if he has been so employed for 2 years or more but less than 5 years; and

(d) 4 weeks’ notice if he has been so employed for 5 years or more.

(4) This section shall not be taken to prevent either party from waiving his right to notice on any occasion.

(5) Such notice shall be written and may be given at any time, and the day on which the notice is given shall be included in the period of the notice.

Termination of contract without notice

11.—(1) Either party to a contract of service may terminate the contract of service without notice or, if notice has already been given in accordance with section 10, without waiting for the expiry of that notice, by paying to the other party a sum equal to the amount of salary at the gross rate of pay which would have accrued to the employee during the period of the notice and in the case of a monthly-rated employee where the period of the notice is less than a month, the amount payable for any one day shall be the gross rate of pay for one day’s work.

[21/84; 36/95]

(2) Either party to a contract of service may terminate the contract of service without notice in the event of any wilful breach by the other party of a condition of the contract of service.

[21/84; 36/95]

Contractual age

12.—(1) Notwithstanding anything in any other written law, a person below the age of 18 years shall, subject to the provisions of this Act, be competent to enter into a contract of service.

(2) No contract of service as an employee shall be enforceable against a person below the age of 18 years and no damages or indemnity shall be recoverable from that person in respect of the contract of service unless it is for his benefit.

When contract deemed to be broken by employer and employee

13.—(1) An employer shall be deemed to have broken his contract of service with the employee if he fails to pay salary in accordance with Part III.

(2) An employee is deemed to have broken the employee’s contract of service with the employer if the employee is absent from work for more than 2 days continuously without prior leave from the employer and —

(a) the employee has no reasonable excuse for the absence; or

(b) the employee does not inform and does not attempt to inform the employer of the excuse for the absence.

[Act 27 of 2015 wef 22/08/2015]

Dismissal

14.—(1) An employer may after due inquiry dismiss without notice an employee employed by him on the grounds of misconduct inconsistent with the fulfilment of the express or implied conditions of his service except that instead of dismissing an employee an employer may —

(a) instantly down-grade the employee; or

(b) instantly suspend him from work without payment of salary for a period not exceeding one week.

(2) Despite subsection (1), but subject to section 3 of the Employment Claims Act 2016 (Act 21 of 2016), where a relevant employee considers that he has been dismissed without just cause or excuse by his employer, the employee may lodge a claim, under section 13 of that Act, for one of the following remedies:

(a) reinstatement in his former employment;

(b) compensation.

[Act 55 of 2018 wef 01/04/2019]

(2A) For the purposes of subsection (2), a relevant employee means —

(a) an employee employed in a managerial or an executive position —

(i) who is dismissed with notice; or

(ii) who is dismissed without notice but receives payment of any salary in lieu of notice,

after having served that employer for at least 6 months in any position (whether or not a managerial or an executive position);

[Act 55 of 2018 wef 01/04/2019]

(b) an employee employed in a managerial or an executive position who is dismissed without notice and without salary in lieu of such notice; or

(c) an employee not employed in a managerial or an executive position.

[Act 26 of 2013 wef 01/04/2014]

(3) If a Tribunal hearing the claim is satisfied that the employee has been dismissed without just cause or excuse, the Tribunal may, despite any rule of law or agreement to the contrary —

(a) in a claim for reinstatement of the employee in his former employment, direct the employer —

(i) to reinstate the employee in the employee’s former employment; and

(ii) to pay the employee an amount equivalent to the wages that the employee would have earned, if the employee had not been dismissed; or

(b) in a claim for compensation, direct the employer to pay, as compensation to the employee, an amount of wages determined by the Tribunal.

[Act 55 of 2018 wef 01/04/2019]

(4) [Deleted by Act 55 of 2018 wef 01/04/2019]

(5) [Deleted by Act 55 of 2018 wef 01/04/2019]

(6) [Deleted by Act 55 of 2018 wef 01/04/2019]

(7) [Deleted by Act 55 of 2018 wef 01/04/2019]

(7A) [Deleted by Act 55 of 2018 wef 01/04/2019]

(8) For the purposes of an inquiry under subsection (1), the employer —

(a) may suspend the employee from work for —

(i) a period not exceeding one week; or

(ii) such longer period as the Commissioner may determine on an application by the employer; but

(b) must pay the employee at least half the employee’s salary during the period the employee is suspended from work.

[Act 55 of 2018 wef 01/04/2019]

(9) If the inquiry does not disclose any misconduct on the part of the employee, the employer shall immediately restore to the employee the full amount of the salary so withheld.

Termination by employee threatened by danger

15. An employee may terminate his contract of service with his employer without notice where he or his dependant is immediately threatened by danger to the person by violence or disease such as the employee did not by his contract of service undertake to run.

Liability on breach of contract

16. Subject to anything in the contract of service to the contrary, the party who breaks the contract of service shall be liable to pay to the other party a sum equal to the amount he would have been liable to pay under section 11 had he terminated the contract of service without notice or with insufficient notice.

Contract of service not to restrict rights of employees to join, participate in or organise trade unions

17. Subject to any other written law for the time being in force, nothing in any contract of service shall in any way restrict the right of any employee who is a party to such contract —

(a) to join a registered trade union;

(b) to participate in the activities of a registered trade union, whether as an officer of the trade union or otherwise; or

(c) to associate with any other persons for the purpose of organising a trade union in accordance with the provisions of the Trade Unions Act (Cap. 333).

Change of employer

18.—(1) If by or under any written law a contract of employment between any body corporate and an employee is modified and some other body corporate is substituted as the employer, the employee’s period of employment at the time when the modification takes effect shall count as a period of employment with such other body corporate, and the change of employer shall not break the continuity of the period of employment.

[36/95; 32/2008]

(2) If on the death of an employer the employee is taken into the employment of the personal representatives or trustees of the deceased, the employee’s period of employment at the time of the death shall count as a period of employment with the employer’s personal representatives or trustees, and the death of the employer shall not break the continuity of the period of employment.

[36/95]

(3) If there is a change in the partners, personal representatives or trustees who employ any person, the employee’s period of employment at the time of the change shall count as a period of employment with the partners, personal representatives or trustees after the change, and the change shall not break the continuity of the period of employment.

[36/95]

Transfer of employment

18A.—(1) If an undertaking (whether or not it is an undertaking established by or under any written law) or part thereof is transferred from one person to another —

(a) such transfer shall not operate to terminate the contract of service of any person employed by the transferor in the undertaking or part transferred but such contract of service shall have effect after the transfer as if originally made between the person so employed and the transferee; and

(b) the period of employment of an employee in the undertaking or part transferred at the time of transfer shall count as a period of employment with the transferee, and the transfer shall not break the continuity of the period of employment.

[36/95]

(2) Without prejudice to subsection (1), on completion of a transfer referred to in that subsection —

(a) all the transferor’s rights, powers, duties and liabilities under or in connection with any such contract of service shall be transferred by virtue of this section to the transferee;

(b) any act or omission done before the transfer by the transferor in respect of that contract of service shall be deemed to have been done by the transferee; and

(c) any act or omission done before the transfer by an employee employed in the undertaking or part transferred in relation to the transferor shall be deemed to have been done in relation to the transferee.

[36/95]

(3) On the completion of a transfer referred to in subsection (1), it is hereby declared for the avoidance of doubt that the terms and conditions of service of an employee whose contract of service is preserved under that subsection shall be the same as those enjoyed by him immediately prior to the transfer.

[36/95]

(4) Subsections (1) and (2) shall not transfer or otherwise affect the liability of any person to be prosecuted for, convicted of and sentenced for any offence.

[36/95]

(5) As soon as it is reasonable and before a transfer under subsection (1) takes place, to enable consultations to take place between the transferor and the affected employees and between the transferor and a trade union of affected employees (if any), the transferor shall notify the affected employees and the trade union of affected employees (if any) of —

(a) the fact that the transfer is to take place, the approximate date on which it is to take place and the reasons for it;

(b) the implications of the transfer and the measures that the transferor envisages he will, in connection with the transfer, take in relation to the affected employees or, if he envisages that no measures will be so taken, that fact; and

(c) the measures that the transferee envisages he will, in connection with the transfer, take in relation to such of those employees as, by virtue of subsection (1), become employees of the transferee after the transfer or, if he envisages that no measures will be so taken, that fact.

[36/95]

(6) As soon as it is reasonable, the transferee shall give the transferor such information so as to enable the transferor to perform the duty imposed on him by virtue of subsection (5)(c).

[36/95]

(7) Where the Commissioner considers that there has been an inordinate delay —

(a) by the transferor in notifying the affected employees or a trade union of affected employees of the matters set out in subsection (5); or

(b) by the transferee in notifying the transferor of the information set out in subsection (6),

the Commissioner may, by notice in writing, direct the transferor to comply with subsection (5) or the transferee to comply with subsection (6), as the case may be, within such time as may be specified in the notice.

[36/95]

(8) Where, immediately before a transfer referred to in subsection (1), a trade union is recognised by the transferor for the purposes of the Industrial Relations Act (Cap. 136) in respect of any employee who in consequence of the transfer becomes the employee of the transferee, the trade union shall, after the transfer —

(a) be deemed to be recognised by the transferee for the purposes of the Industrial Relations Act if, after the transfer, the majority of employees employed by the transferee are members of the trade union; or

(b) in any other case, be deemed to be recognised by the transferee only for the purpose of representing the employee on any dispute arising —

(i) from any collective agreement that was entered into between the transferor and the trade union while the collective agreement remains in force; or

(ii) from the transfer of the employee’s employment from the transferor to the transferee under this section.

[36/95]

(8A) For the purposes of subsection (8)(b), any collective agreement that was entered into between the transferor and the trade union of the affected employees and in force immediately before the transfer shall continue in force between the transferee and the trade union of the affected employees for a period of 18 months after the date of the transfer or until the date of its expiry as specified in the collective agreement, whichever is the later.

[Act 26 of 2013 wef 01/04/2014]

(9) A dispute or disagreement between the transferor and an employee or the transferee and an employee arising from a transfer under subsection (1), whether before or after the transfer, may be referred by a party to the dispute or disagreement to the Commissioner under section 115 and shall be deemed to be a dispute to which that section applies.

[36/95]

(10) Where a dispute or disagreement has been referred to the Commissioner pursuant to subsection (9), the Commissioner shall, in addition to the powers conferred under section 115, have the powers —

(a) to delay or prohibit the transfer of employment of the employee to the dispute from the transferor to the transferee under subsection (1); and

(b) to order that the transfer of employment of the employee to the dispute from the transferor to the transferee under subsection (1) be subject to such terms as the Commissioner considers just.

[36/95]

(11) The Minister may make such regulations as he considers necessary or expedient to give effect to the provisions of this section and, in particular, may make regulations —

(a) to provide for the form and manner of consultations between the transferor and the affected employees and between the transferor and a trade union of affected employees under subsection (5);

(b) for the type of information that must be communicated by the transferor to the affected employees and to a trade union of affected employees under subsection (5), or by the transferee to the transferor under subsection (6); and

(c) to provide for a mechanism for conciliation of disputes arising out of or relating to a transfer referred to in subsection (1) between any employer and employee.

[36/95]

(12) Nothing in this section shall prevent a transferee of an undertaking referred to in subsection (1) and an employee whose contract of service is preserved under that subsection or a trade union representing such an employee from negotiating for and agreeing to terms of service different from those contained in the contract of service that is preserved under that subsection.

[36/95]

(13) In this section —

“affected employee” means any employee of the transferor who may be affected by a transfer under subsection (1) or may be affected by the measures taken in connection with such a transfer;

“trade union” means a trade union which has been —

(a) registered under any written law for the time being in force relating to the registration of trade unions; and

(b) accorded recognition by the employer pursuant to section 17(1) of the Industrial Relations Act (Cap. 136);

“transfer” includes the disposition of a business as a going concern and a transfer effected by sale, amalgamation, merger, reconstruction or operation of law;

“undertaking” includes any trade or business.

[36/95]

Offence

19. Any employer who enters into a contract of service or collective agreement contrary to the provisions of this Part shall be guilty of an offence.

PART 3

PAYMENT OF SALARY

Fixation of salary period

20.—(1) An employer may fix periods, which for the purpose of this Act shall be called salary periods, in respect of which salary earned shall be payable.

(2) No salary period shall exceed one month.

(3) In the absence of a salary period so fixed, the salary period shall be deemed to be one month.

Computation of salary for incomplete month’s work

20A.—(1) If a monthly-rated employee has not completed a whole month of service because —

(a) he commenced employment after the first day of the month;

(b) his employment was terminated before the end of the month;

(c) he took leave of absence without pay for one or more days of the month; or

(d) he took leave of absence to perform his national service under the Enlistment Act (Cap. 93),

the salary due to him for that month shall be calculated in accordance with the following formula:

(Monthly gross rate of pay/ Number of days on which the employee is required to work in that month) x Number of days the employee actually worked in that month.

[36/95]

(2) In calculating the number of days actually worked by an employee in a month under subsection (1), any day on which an employee is required to work for 5 hours or less under his contract of service shall be regarded as half a day.

Time of payment

21.—(1) Salary earned by an employee under a contract of service, other than additional payments for overtime work, shall be paid before the expiry of the 7th day after the last day of the salary period in respect of which the salary is payable.

[21/84]

(2) Additional payments for overtime work shall be paid not later than 14 days after the last day of the salary period during which the overtime work was performed.

[21/84]

(3) The total salary due to an employee on completion of his contract of service shall be paid to him on completion of the contract.

Payment on dismissal

22. Subject to the provisions of this Act, the total salary and any sum due to an employee who has been dismissed shall be paid on the day of dismissal or, if this is not possible, within 3 days thereafter, not being a rest day or public holiday or other holiday.

[32/2008]

Payment on termination by employee

23.—(1) Subject to the provisions of this Act, the total salary due to an employee who terminates his contract of service with his employer under section 11 or after giving due notice to the employer as required under section 10 shall be paid to him on the day on which the contract of service is terminated.

(2) Subject to the provisions of this Act, the total salary due to an employee who terminates his contract of service without giving prior notice to his employer as required under section 10, or, if notice has already been given under that section, but the employee terminates his contract of service without waiting for the expiry of the notice, shall be paid to him before the expiry of the 7th day after the day on which he terminates his contract of service.

(3) The employer may, subject to any order made by a court or the Commissioner to the contrary, deduct from the salary due to the employee such sum as the employee is liable to pay in lieu of prior notice under section 11(1).

Income tax clearance

24.—(1) Notwithstanding sections 22 and 23, no payment of salary or any other sum due to an employee on termination of service shall be made to the employee by the employer without the permission of the Comptroller of Income Tax under section 68(7) of the Income Tax Act (Cap. 134).

[32/2008]

(2) The employer shall immediately give notice of the termination of service to the Comptroller of Income Tax and the payment of the salary or other sum due to the employee shall not be delayed more than 30 days after such notice has been given to and received by the Comptroller of Income Tax.

[32/2008]

Payment to be made during working hours

25.—(1) Payment of salary shall be made on a working day and during working hours at the place of work or at any other place agreed to between the employer and the employee.

[21/84]

(2) Subsection (1) shall not apply where the salary is paid into an account with a bank in Singapore, being an account in the name of the employee or an account in the name of the employee jointly with one or more other persons.

[21/84]

No unauthorised deductions to be made

26. No deduction shall be made by an employer from the salary of an employee, unless the deduction is authorised by or under any provision of this Act or is required to be made —

(a) by order of a court or other authority competent to make such order;

(b) pursuant to a declaration made by the Comptroller of Income Tax under section 57 of the Income Tax Act (Cap. 134), the Comptroller of Property Tax under section 38 of the Property Tax Act (Cap. 254) or the Comptroller of Goods and Services Tax under section 79 of the Goods and Services Tax Act (Cap. 117A) that the employer is an agent for recovery of income tax, property tax or goods and services tax (as the case may be) payable by the employee; or

(c) pursuant to a direction given by the Comptroller of Income Tax under section 91 of the Income Tax Act.

[Act 26 of 2013 wef 01/04/2014]

Authorised deductions

27.—(1) The following deductions may be made from the salary of an employee:

(a) deductions for absence from work;

(b) deductions for damage to or loss of goods expressly entrusted to an employee for custody or for loss of money for which an employee is required to account, where the damage or loss is directly attributable to his neglect or default;

(c) [Deleted by Act 55 of 2018 wef 01/04/2019]

(d) deductions made with the written consent of the employee for house accommodation supplied by the employer;

[Act 55 of 2018 wef 01/04/2019]

(e) deductions made with the written consent of the employee for such amenities and services supplied by the employer as the Commissioner may authorise;

[Act 55 of 2018 wef 01/04/2019]

(f) any deduction for the recovery of any advance, loan or unearned employment benefit, or for the adjustment of any overpayment of salary;

[Act 55 of 2018 wef 01/04/2019]

(g) [Deleted by Act 26 of 2013 wef 01/04/2014]

(h) deductions of contributions payable by an employer on behalf of an employee under and in accordance with the provisions of the Central Provident Fund Act (Cap. 36);

(i) any deduction (other than a deduction mentioned in paragraphs (a) to (h), (j) and (k)) made with the written consent of the employee;

[Act 55 of 2018 wef 01/04/2019]

(j) deductions made with the written consent of the employee and paid by the employer to any cooperative society registered under any written law for the time being in force in respect of subscriptions, entrance fees, instalments of loans, interest and other dues payable by the employee to such society; and

(k) any other prescribed deductions.

[Act 55 of 2018 wef 01/04/2019]

(1A) A written consent of an employee for any deduction mentioned in subsection (1)(d), (e), (i) or (j) may be withdrawn by the employee giving written notice of the withdrawal to the employer at any time before the deduction is made.

[Act 55 of 2018 wef 01/04/2019]

(1B) An employee cannot be penalised for withdrawing a written consent for any deduction mentioned in subsection (1)(d), (e), (i) or (j).

[Act 55 of 2018 wef 01/04/2019]

(2) For the purposes of subsection (1)(e), “services” does not include the supply of tools and raw materials required for the purposes of employment.

(3) In subsection (1)(f), “employment benefit” —

(a) means any benefit that an employee derives from being employed, other than salary; and

(b) includes (but is not limited to) benefits such as the following:

(i) any annual leave in excess of the annual leave to which the employee is entitled under section 88A;

(ii) any flexible employment benefit (such as an allowance that can be utilised, at the employee’s discretion, for any of certain purposes specified in the employee’s contract of service).

[Act 55 of 2018 wef 01/04/2019]

Deductions for absence

28.—(1) Deductions may be made under section 27(1)(a) only on account of the absence of an employee from the place where, by the terms of his employment, he is required to work, the absence being for the whole or any part of the period during which he is so required to work.

(2) The amount of any deduction referred to in subsection (1) shall in no case bear to the salary payable at the gross rate of pay to the employee in respect of the salary period for which the deduction is made a larger proportion than the period for which he was absent bears to the total period, within such salary period, during which he was required to work by the terms of his employment, and in the case of a monthly-rated employee the amount of deduction in respect of any one day shall be the gross rate of pay for one day’s work.

[36/95]

(3) If any employee absents himself from work otherwise than as provided by this Act or by his contract of service, the employer may, subject to any order which may be made by a court or by the Commissioner on complaint of either party, deduct from any salary due to the employee the cost of food supplied to him during his absence.

Deductions for damages or loss

29.—(1) A deduction under section 27(1)(b) shall not exceed the amount of the damages or loss caused to the employer by the neglect or default of the employee and except with the permission of the Commissioner shall in no case exceed one-quarter (or such other proportion prescribed in substitution by the Minister) of one month’s wages and shall not be made until the employee has been given an opportunity of showing cause against the deduction.

[21/84]

[Act 26 of 2013 wef 01/04/2014]

(2) All such deductions and all realisations thereof shall be recorded in a register to be kept by the employer in such form as may be prescribed.

Deductions for accommodation, amenity and service

30.—(1) [Deleted by Act 55 of 2018 wef 01/04/2019]

(2) Any deduction under section 27(1)(d) or (e) shall not exceed an amount equivalent to the value of the house accommodation, amenity or service supplied, and the total amount of all deductions under section 27(1)(d) and (e) made from the salary of the employee by his employer in any one salary period shall in no case exceed one-quarter (or such other proportion prescribed in substitution by the Minister) of the salary payable to the employee in respect of that period.

(3) In the case of a deduction under section 27(1)(e), the deduction shall be subject to such conditions as the Commissioner may impose.

[Act 26 of 2013 wef 01/04/2014]

Recovery of advances and loans

31.—(1) The recovery of an advance of money made to an employee before the commencement of a contract of service shall begin from the first payment of salary in respect of a completed salary period, but no recovery shall be made of any such advance made for travelling expenses.

(2) Advances may be recovered in instalments by deductions from salary spread over not more than 12 months.

(3) No instalment under subsection (2) shall exceed one-quarter (or such other proportion prescribed in substitution by the Minister) of the salary due for the salary period in respect of which the deduction is made.

[Act 26 of 2013 wef 01/04/2014]

(4) Loans may be recovered in instalments by deductions from salary.

(5) No instalment under subsection (4) shall exceed one-quarter (or such other proportion prescribed in substitution by the Minister) of the salary due for the salary period in respect of which the deduction is made.

[Act 26 of 2013 wef 01/04/2014]

Deductions not to exceed prescribed limit

32.—(1) The total amount of all deductions made from the salary of an employee by an employer in any one salary period, other than deductions under section 27(1)(a), (f) or (j), shall not exceed 50% (or such other percentage prescribed in substitution by the Minister) of the salary payable to the employee in respect of that period.

[21/84]

[Act 26 of 2013 wef 01/04/2014]

(2) Subsection (1) shall not apply to deductions made from the last salary due to an employee on termination of his contract of service or on completion of his contract of service.

[21/84]

Priority of salary to other debts

33.—(1) This section shall apply —

(a) to workmen who are in receipt of a salary not exceeding $4,500 a month (excluding overtime payments, bonus payments, annual wage supplements, productivity incentive payments and any allowance however described) or such other amount as may be prescribed by the Minister; and

(b) to every employee (other than a workman or a person employed in a managerial or an executive position) who receives a salary not exceeding $2,600 a month (excluding any overtime payment, bonus payment, annual wage supplement, productivity incentive payment and any allowance however described) or such other amount as the Minister may prescribe.

[Act 55 of 2018 wef 01/04/2019]

(2) When, on the application of a person holding a mortgage, charge or lien or of a person who has obtained a judgment or decree, the property of an employer is sold, or any money due to the employer is garnished, the court ordering the sale or garnishment shall not distribute the proceeds of the sale or the money to the person entitled thereto unless the court has ascertained and paid the salary due to all the employees employed by that employer and to all employees engaged by a contractor or subcontractor and working for that employer.

(3) This section shall only apply —

(a) to property on which those employees were or are working;

(b) where the property sold was or is the produce of the work of those employees;

(c) where the property sold is movable property used or being used by those employees in the course of their work; or

(d) to money due to the employer in respect of work done by those employees.

(4) The amount payable to each such employee under subsection (2) shall not exceed 5 months’ salary.

(5) [Deleted by Act 21 of 2016 wef 01/04/2017]

(6) [Deleted by Act 21 of 2016 wef 01/04/2017]

(7) For the purposes of this section, “employees” shall be deemed to include subcontractors for labour and “salary” shall be deemed to include money due to a subcontractor for labour.

Offence

34.—(1) Any employer failing to pay salary in accordance with the provisions of this Part shall be guilty of an offence.

[Act 26 of 2013 wef 01/04/2014]

(2) Any employer who is guilty of an offence under subsection (1) for contravening section 21, 22 or 23 shall be liable on conviction —

(a) to a fine of not less than $3,000 and not more than $15,000 or to imprisonment for a term not exceeding 6 months or to both; and

(b) if the employer is a repeat offender, to a fine of not less than $6,000 and not more than $30,000 or to imprisonment for a term not exceeding 12 months or to both.

[Act 26 of 2013 wef 01/04/2014]

(3) For the purposes of subsection (2), a person is a repeat offender in relation to an offence under subsection (1) if the person who is convicted or found guilty of an offence under subsection (1) of contravening section 21, 22 or 23 (referred to as the current offence) has been convicted or found guilty of an offence of contravening section 21, 22 or 23 on at least one other occasion (whether before, on or after the date of commencement of section 2(11) of the Employment, Parental Leave and Other Measures Act 2013) before the date on which he is convicted or found guilty of the current offence.

[Act 26 of 2013 wef 01/04/2014]

PART 4

REST DAYS, HOURS OF WORK AND OTHER CONDITIONS OF SERVICE

Application of this Part to certain workmen and other employees

35. The provisions of this Part shall apply —

(a) to workmen who are in receipt of a salary not exceeding $4,500 a month (excluding overtime payments, bonus payments, annual wage supplements, productivity incentive payments and any allowance however described) or such other amount as may be prescribed by the Minister; and

(b) to every employee (other than a workman or a person employed in a managerial or an executive position) who receives a salary not exceeding $2,600 a month (excluding any overtime payment, bonus payment, annual wage supplement, productivity incentive payment and any allowance however described) or such other amount as the Minister may prescribe.

[Act 55 of 2018 wef 01/04/2019]

Rest day

36.—(1) Every employee shall be allowed in each week a rest day without pay of one whole day which shall be Sunday or such other day as may be determined from time to time by the employer.

[36/95]

(2) The employer may substitute any continuous period of 30 hours as a rest day for an employee engaged in shift work.

(3) Where in any week a continuous period of 30 hours commencing at any time before 6 p.m. on a Sunday is substituted as a rest day for an employee engaged in shift work, such rest day shall be deemed to have been granted within the week notwithstanding that the period of 30 hours ends after the week.

[21/84]

(4) Where the rest day of an employee is determined by his employer, the employer shall prepare or cause to be prepared a roster before the commencement of the month in which the rest days fall informing the employee of the days appointed to be his rest days therein.

Work on rest day

37.—(1) Subject to section 38(2) or 40(2A), no employee shall be compelled to work on a rest day unless he is engaged in work which by reason of its nature requires to be carried on continuously by a succession of shifts.

[32/2008]

(1A) In the event of any dispute, the Commissioner shall have power to decide whether or not an employee is engaged in work which by reason of its nature requires to be carried on continuously by a succession of shifts.

(2) An employee who at his own request works for an employer on a rest day shall be paid for that day —

(a) if the period of work does not exceed half his normal hours of work, a sum at the basic rate of pay for half a day’s work;

(b) if the period of work is more than half but does not exceed his normal hours of work, a sum at the basic rate of pay for one day’s work; or

(c) if the period of work exceeds his normal hours of work for one day —

(i) a sum at the basic rate of pay for one day’s work; and

(ii) a sum at the rate of not less than one and a half times his hourly basic rate of pay for each hour or part thereof that the period of work exceeds his normal hours of work for one day.

[36/95]

(3) An employee who at the request of his employer works on a rest day shall be paid for that day —

(a) if the period of work does not exceed half his normal hours of work, a sum at the basic rate of pay for one day’s work;

(b) if the period of work is more than half but does not exceed his normal hours of work, a sum at the basic rate of pay for 2 days’ work; or

(c) if the period of work exceeds his normal hours of work for one day —

(i) a sum at the basic rate of pay for 2 days’ work; and

(ii) a sum at the rate of not less than one and a half times his hourly basic rate of pay for each hour or part thereof that the period of work exceeds his normal hours of work for one day.

[36/95]

(3A) In this section —

(a) “normal hours of work” means the number of hours of work (not exceeding the limits applicable to an employee under section 38 or 40, as the case may be) that is agreed between an employer and an employee to be the usual hours of work per day; or in the absence of any such agreement, shall be deemed to be 8 hours a day; and

(b) an employee’s “hourly basic rate of pay” is to be calculated in the same manner as for the purpose of calculating payment due to an employee under section 38 for working overtime.

[36/95]

(4) Subsection (3) shall not apply to any employee who is employed by the Government or a statutory body in any of the essential services as defined under Part III of the Criminal Law (Temporary Provisions) Act (Cap. 67), but any such employee who at the request of his employer works on a rest day or part thereof shall be given a day or part of a day off, as the case may be, in substitution for such a rest day or part thereof.

Hours of work

38.—(1) Except as hereinafter provided, an employee shall not be required under his contract of service to work —

(a) more than 6 consecutive hours without a period of leisure;

(b) more than 8 hours in one day or more than 44 hours in one week:

Provided that —

(i) an employee who is engaged in work which must be carried on continuously may be required to work for 8 consecutive hours inclusive of a period or periods of not less than 45 minutes in the aggregate during which he shall have the opportunity to have a meal;

(ii) where, by agreement under the contract of service between the employee and the employer, the number of hours of work on one or more days of the week is less than 8, the limit of 8 hours in one day may be exceeded on the remaining days of the week, but so that no employee shall be required to work for more than 9 hours in one day or 44 hours in one week;

(iii) where, by agreement under the contract of service between the employee and the employer, the number of days on which the employee is required to work in a week is not more than 5 days, the limit of 8 hours in one day may be exceeded but so that no employee shall be required to work more than 9 hours in one day or 44 hours in one week; and

(iv) where, by agreement under the contract of service between the employee and the employer, the number of hours of work in every alternate week is less than 44, the limit of 44 hours in one week may be exceeded in the other week, but so that no employee shall be required to work for more than 48 hours in one week or for more than 88 hours in any continuous period of 2 weeks.

[21/84]

(2) An employee may be required by his employer to exceed the limit of hours prescribed in subsection (1) and to work on a rest day, in the case of —

(a) accident, actual or threatened;

(b) work, the performance of which is essential to the life of the community;

(c) work essential for defence or security;

(d) urgent work to be done to machinery or plant;

(e) an interruption of work which it was impossible to foresee; or

(f) work to be performed by employees in any industrial undertaking essential to the economy of Singapore or any of the essential services as defined under Part III of the Criminal Law (Temporary Provisions) Act (Cap. 67).

(3) In the event of any dispute, the Commissioner shall have power to decide whether or not the employer is justified in calling upon the employee to work in the circumstances specified in subsection (2)(f).

(4) If an employee at the request of the employer works —

(a) more than 8 hours in one day except as provided in paragraphs (ii) and (iii) of the proviso to subsection (1), or more than 9 hours in one day in any case specified in those paragraphs; or

(b) more than 44 hours in one week except as provided in paragraph (iv) of the proviso to subsection (1), or more than 48 hours in any one week or more than 88 hours in any continuous period of 2 weeks in any case specified in that paragraph,

he shall be paid for such extra work at the rate of not less than one and a half times his hourly basic rate of pay irrespective of the basis on which his rate of pay is fixed.

[21/84; 36/95]

(5) An employee shall not be permitted to work overtime for more than 72 hours a month.

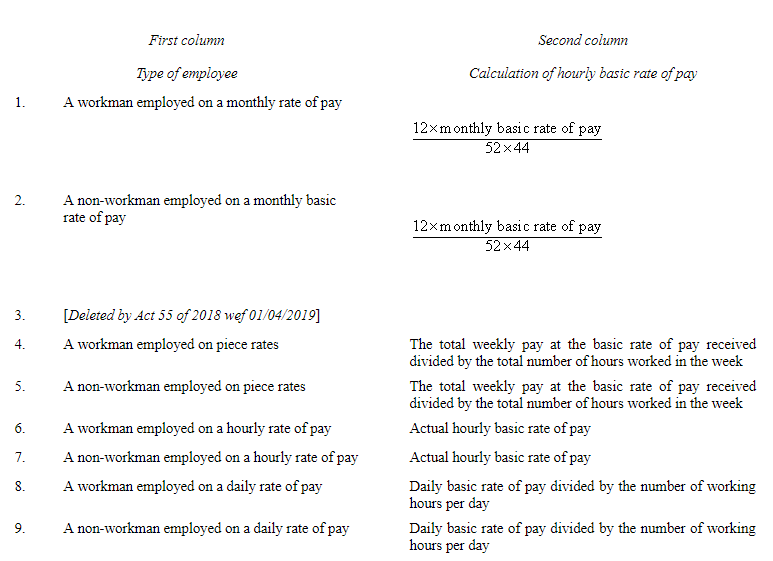

(6) For the purpose of calculating under subsection (4) the payment due for overtime to an employee referred to in the first column of the Fourth Schedule, the employee’s hourly basic rate of pay shall be determined in accordance with the second column of the Fourth Schedule.

[Act 26 of 2013 wef 01/04/2014]

(7) The Minister may make regulations for the purpose of calculating the payment due for overtime to an employee employed on piece rates.

(8) Except in the circumstances described in subsection (2)(a), (b), (c), (d) and (e), no employee shall under any circumstances work for more than 12 hours in any one day.

(9) This section shall not apply to employees engaged in the fire services or in work which by its nature involves long hours of inactive or stand-by employment.

Task work

39. Nothing in this Part shall prevent any employer from agreeing with any employee that the salary of the employee shall be paid at an agreed rate in accordance with the task, that is, the specific amount of work required to be performed, and not by the day or by the piece.

Shift workers, etc.

40.—(1) Notwithstanding section 38(1), an employee who is engaged under his contract of service in regular shift work or who has otherwise consented in writing to work in accordance with the hours of work specified in this section may be required to work more than 6 consecutive hours, more than 8 hours in any one day or more than 44 hours in any one week but the average number of hours worked over any continuous period of 3 weeks shall not exceed 44 hours per week.

[21/84]

(2) No consent given by an employee under this section shall be valid unless this section and section 38 have been explained to the employee and the employee has been informed of the times at which the hours of work begin and end, the number of working days in each week and the weekly rest day.

[21/84]

(2A) An employee to whom this section applies may be required by his employer to exceed the limit of hours prescribed in subsection (1) and to work on a rest day, in the case of —

(a) accident, actual or threatened;

(b) work, the performance of which is essential to the life of the community;

(c) work essential for defence or security;

(d) urgent work to be done to machinery or plant;

[Act 26 of 2013 wef 01/04/2014]

(e) an interruption of work which it was impossible to foresee; or

[32/2008]

[Act 26 of 2013 wef 01/04/2014]

(f) work to be performed by employees in any industrial undertaking essential to the economy of Singapore or any of the essential services as defined under Part III of the Criminal Law (Temporary Provisions) Act (Cap. 67).

[Act 26 of 2013 wef 01/04/2014]

(3) Except in the circumstances described in subsection (2A)(a), (b), (c), (d) and (e), no employee to whom this section applies shall under any circumstances work for more than 12 hours in any one day.

[21/84; 32/2008]

(4) Section 38(4) shall not apply to any employee to whom this section applies, but any such employee who at the request of his employer works more than an average of 44 hours per week over any continuous period of 3 weeks shall be paid for such extra work in accordance with section 38(4).

[21/84]

Interpretation of “week” for purposes of sections 36, 38 and 40

41. For the purposes of sections 36, 38 and 40, “week” shall mean a continuous period of 7 days commencing at midnight on Sunday.

[21/84]

Power to exempt

41A.—(1) The Commissioner may, after considering the operational needs of the employer and the health and safety of the employee or class of employees, by order in writing exempt an employee or any class of employees from sections 38(1), (5) and (8) and 40(3) subject to such conditions as the Commissioner thinks fit.

[36/95; 41/2004]

(2) The Commissioner may, after considering the operational needs of an employer and the interests of an employee or a class of employees, by order in writing, direct that the entitlement to be paid for extra work under section 37(2) or (3), 38(4), 40(4) or 88(4) shall not apply to that employee or class of employees, subject to such conditions as the Commissioner thinks fit.

[41/2004; 32/2008]

(3) Where the Commissioner —

(a) exempts an employee or any class of employees from section 38(1), (5) or (8) or 40(3); or

(b) directs that the entitlement to be paid for extra work under section 37(2) or (3), 38(4), 40(4) or 88(4) shall not apply to an employee or any class of employees, the employer shall display the order or a copy thereof conspicuously in the place where the employee or class of employees are employed.

[41/2004; 32/2008]

Holidays

42. [Repealed by Act 32 of 2008]

43. [Repealed by Act 55 of 2018 wef 01/04/2019]

Sick Leave

44. [Repealed by Act 32 of 2008]

Payment of retrenchment benefit

45. No employee who has been in continuous service with an employer for less than 2 years shall be entitled to any retrenchment benefit on his dismissal on the ground of redundancy or by reason of any reorganisation of the employer’s profession, business, trade or work.

[32/2008]

[Act 26 of 2013 wef 01/04/2015]

Retirement benefit

No employee who has been in continuous service with an employer for less than 5 years shall be entitled to any retirement benefit other than the sums payable under the Central Provident Fund Act (Cap. 36) on the cessation of his service with the employer.

Priority of retirement benefits, etc.

47.—(1) Where a collective agreement or an award contains a provision for the payment of a gratuity or other sum of money to an employee on his or her retirement or on the termination of his or her services under such circumstances as may be provided for in the collective agreement or award, the gratuity or other sum of money which is due and owing to the employee is to be included among —

(a) the debts which, under section 203 of the Insolvency, Restructuring and Dissolution Act 2018, are to be paid in priority to all other unsecured debts in the winding up of a company and that gratuity or sum of money ranks after the preferential debts referred to in that section;

[S 26/2022 wef 13/01/2022]

(b) the debts which, under section 352 of the Insolvency, Restructuring and Dissolution Act 2018, are to be paid in priority to all other debts in the distribution of the property of a bankrupt or of a person dying insolvent;

[40/2018]

[S 26/20222 wef 13/01/2022]

(c)the debts which, under the repealed section 328 of the Companies Act 1967 (as applied by section 130 of the VCC Act as in force before the operative date), are to be paid in priority to all other unsecured debts in the winding up of a VCC and that gratuity or sum of money ranks after the preferential debts mentioned in that section;

[S 26/20222 wef 13/01/2022]

(d) the debts which, under section 203 of the Insolvency, Restructuring and Dissolution Act 2018 (as applied by section 130 of the VCC Act as in force on the operative date), are to be paid in priority to all other unsecured debts in the winding up of a VCC, and that gratuity or sum of money ranks after the preferential debts mentioned in that section;

[S 26/20222 wef 13/01/2022]

(e) the debts which, under the repealed section 328 of the Companies Act 1967 (as applied by section 33(2) of the VCC Act read with the First Schedule to the VCC Act as in force before the operative date) are to be paid in priority to all other unsecured debts in the winding up of a sub-fund of an umbrella VCC, and that gratuity or sum of money ranks after the preferential debts mentioned in that section; or

[S 26/20222 wef 13/01/2022]

(f) the debts which, under section 203 of the Insolvency, Restructuring and Dissolution Act 2018 (as applied by section 33(2) of the VCC Act read with the First Schedule to the VCC Act as in force on the operative date), are to be paid in priority to all other unsecured debts in the winding up of a sub-fund of an umbrella VCC, and that gratuity or sum of money ranks after the preferential debts mentioned in that section.

[S 26/20222 wef 13/01/2022]

(2) Where a collective agreement or an award contains a provision for the payment of a gratuity or other sum of money to an employee on his retirement and no provision is made for the payment of a gratuity or other sum of money on the termination of the employee’s services by reason of his employer ceasing to carry on business for whatever reason, or by reason of the employer transferring the whole or part of his undertaking or property, as the case may be, every such collective agreement or award shall, notwithstanding anything contained in any written law or rule of law or collective agreement or award to the contrary, be deemed to contain a provision that in the event of the employer ceasing to carry on business for whatever reason or transferring the whole or part of his undertaking or property, as the case may be, an employee who ceases to be employed by the employer by reason of the happening of such a contingency shall be paid such sum of money as he would have been entitled to receive under the terms of the collective agreement or award if he had retired from the service of the employer on the day the employer ceases to carry on business or transfers the whole or part of his undertaking or property, as the case may be.

[S 26/20222 wef 13/01/2022]

(3) Subsection (2) does not apply where an employer has set up a fund under a scheme for the payment of pensions, gratuities, provident fund or other superannuation benefits to the employer’s employees on their retirement from the service of the employer whereby under the scheme the employees’ benefits are safeguarded in the event of an employer’s bankruptcy or, if the employer is a company or VCC, on the winding up of the company or VCC or in the event of the employer ceasing to carry on business for any other reason or transferring the whole or part of the employer’s undertaking or property, as the case may be.

[S 26/20222 wef 13/01/2022]

(4) Any sum of money payable under subsection (2) is deemed, for the purposes of subsection (1), to be a payment to an employee on his or her retirement and is to be included among the debts referred to in subsection (1)(a) or (b).

(5) For the purposes of this section —

“award” means an award made by the Industrial Arbitration Court under the provisions of the Industrial Relations Act 1960;

“collective agreement” means a collective agreement, a memorandum of which has been certified by the Industrial Arbitration Court in accordance with the provisions of the Industrial Relations Act 1960;

[S 26/2022 wef 13/01/2022]

“company” has the meaning given by section 4(1) of the Companies Act 1967;

[S 26/2022 wef 13/01/2022]

“operative date” means the date of commencement of sections 29, 48 and 62 of the Variable Capital Companies (Miscellaneous Amendments) Act 2019;

[S 26/2022 wef 13/01/2022]

“sub-fund”, “umbrella VCC” and “VCC” have the meanings given by section 2(1) of the VCC Act;

[S 26/2022 wef 13/01/2022]

“VCC Act” means the Variable Capital Companies Act 2018.

[S 26/2022 wef 13/01/2022]

Payment of annual wage supplement or other variable payment

48.—(1) Where a contract of service or collective agreement made before 26th August 1988 provides for the payment by the employer of any annual wage supplement, annual bonus or annual wage increase, such payments shall continue to be payable by the employer until the employer and his employees or a trade union representing his employees have negotiated and agreed to vary such payments.

[21/88]

(2) An employer and his employees or a trade union representing his employees may negotiate for and agree to a variable payment based on the trading results or productivity or on any other criteria agreed upon by the parties concerned.

[21/88]

(3) Where an employer has not paid any annual wage supplement prior to 26th August 1988, any contract of service or collective agreement made on or after that date between the employer and his employees or a trade union representing his employees shall not contain a provision for the payment of an annual wage supplement exceeding the equivalent of one month’s wages of the employees.

[21/88]

(4) Any person who, or any trade union of employees which, requests (whether orally or in writing) or invites negotiations for the payment by an employer of an annual wage supplement which is in excess of the amount specified in subsection (3) and any employer who pays an annual wage supplement exceeding the amount specified in subsection (3) shall be guilty of an offence.

(5) Notwithstanding that an annual wage supplement may be payable under subsection (1) or (3), an employer may, in the event of exceptionally poor business results for any year, invite the employees or a trade union representing his employees to negotiate for a lower quantum of annual wage supplement or for no annual wage supplement to be paid for that year.

[21/88]

Power of Minister to make recommendations for wage adjustments

49. The Minister may, from time to time, make recommendations for wage adjustment and upon the publication of such recommendations in the Gazette the employer and his employees or a trade union representing his employees may negotiate based on such recommendations.

[21/88]

Interpretation for purposes of sections 48 and 49

50.—(1) Where a notice is served under section 18 of the Industrial Relations Act (Cap. 136) by an employer or a trade union representing his employees in respect of any matter referred to in sections 48 and 49 and no agreement is reached between the parties, either party may, notwithstanding the provisions of the Industrial Relations Act, refer the matter to the Industrial Arbitration Court established under the Industrial Relations Act for arbitration.

[21/88]

(2) For the purposes of sections 48 and 49 —

“annual wage supplement” means a single annual payment to employees that is supplemental to the total amount of annual wages earned by them, whether expressed as a percentage thereof or otherwise;

“variable payment” means such payment, however expressed and whether paid annually or otherwise, which serves as an incentive to all employees to increase their productivity or as a reward for their contribution;

“wages” means the basic wages payable to an employee in respect of work done under his contract of service but does not include any commission, overtime allowance or other allowances payable to an employee.

[21/88]

Interpretation of “ordinary rate of pay”

51. [Repealed by Act 36 of 1995]

Power to suspend application of Part IV

The Minister may, by notification in the Gazette, suspend the application of any of the provisions of this Part to any classes of employees when the public interest so requires it.

Offence

53.—(1) Any employer who employs any person as an employee contrary to the provisions of this Part or fails to pay any salary in accordance with the provisions of this Part shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $5,000, and for a second or subsequent offence to a fine not exceeding $10,000 or to imprisonment for a term not exceeding 12 months or to both.

[21/84; 32/2008]

(2) [Deleted by Act 32 of 2008]

(3) [Deleted by Act 55 of 2018 wef 01/04/2019]

PART 5

TRUCK SYSTEM

Agreements to pay salary otherwise than in legal tender illegal

54. The salary of a workman shall be payable in legal tender and not otherwise and if in any contract of service the whole or any part of the salary is made payable in any other manner the contract of service shall be illegal, null and void.

Agreements as to place and manner, etc., of spending salary illegal

55. No contract of service shall contain any terms as to the place at which, or the manner in which, or the person with whom, any salary paid to the workman is to be expended and every contract of service containing such terms shall be illegal, null and void.

Salary to be paid entirely in legal tender

56. Except where otherwise expressly permitted by the provisions of this Act, the entire amount of the salary earned by, or payable to, any workman in respect of any work done by him shall be actually paid to him in legal tender, and every payment of, or on account of, any such salary made in any other form shall be illegal, null and void.

Recovery of salary not paid in legal tender

57. Every workman shall be entitled to recover in any court or before the Commissioner, acting under section 115, so much of his salary exclusive of sums lawfully deducted in accordance with the provisions of this Act as has not been actually paid to him in legal tender.

Interest on advances forbidden

58. No employer shall make any deduction by way of discount, interest or any similar charge on account of any advance of salary made to any workman.

Remuneration other than salary

59. Nothing in this Part shall render illegal a contract of service with a workman for giving to him food, quarters or other allowances or privileges in addition to money salary as a remuneration for his services, but no employer shall give to a workman any noxious drugs or intoxicating liquor by way of remuneration.

Shops and canteens

60.—(1) Nothing in this Part shall prevent the employer from establishing or permitting to be established a shop or a canteen for the sale of foodstuffs, provisions, meals or refreshments; but no workman shall be compelled by any contract of service to purchase any goods at that shop or canteen, and no noxious drugs or intoxicating liquor shall be sold at any such shop or canteen.

[21/84]

(2) No employer shall establish or keep or permit to be established or kept, a shop or canteen on any place of employment for the sale of foodstuffs, provisions, meals or refreshments to his workmen otherwise than in accordance with subsection (1).

Offence

61. Any employer who enters into any contract of service or gives any remuneration for service contrary to the provisions of this Part or declared by this Part to be illegal or receives any payment from any workman contrary to the provisions of this Part or contravenes section 60(2) shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $5,000, and for a second or subsequent offence to a fine not exceeding $10,000 or to imprisonment for a term not exceeding 12 months or to both.

[32/2008]

Proceedings may be taken against actual offender

62. [Repealed by Act 32 of 2008]

Payment of salary through bank

63.—(1) Nothing in section 54 or 56 shall operate so as to render unlawful or invalid any payment of salary by the employer to the workman in any of the following ways:

(a) payment into an account at a bank in Singapore, being an account in the name of the workman or an account in the name of the workman jointly with one or more other persons;

(b) payment by cheque made payable to or to the order of the workman.

[21/84]

(2) Where the salary or part thereof has been paid in any of the ways set out in subsection (1), section 57 shall not operate to give a right of recovery of so much of the salary as has been so paid.

[21/84]

Limitations on application of Part V

64. Nothing in this Part shall be held to apply to any body of persons working on an agreement of co-operation.

PART 6

CONTRACTORS AND CONTRACTING

Liability of principals, contractors and subcontractors for salary of workman